Is This The End Of The World’s Largest Oil Fund?

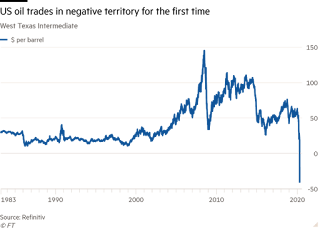

The oil markets have just gone through an epic long squeeze, with oil prices crashing into negative territory for the first time in history.

The May 2020 WTI futures contract sunk an agonizing 310% to minus $38.45/barrel by late Monday afternoon, marking the first time that a futures contract for U.S. crude prices went negative--and made all those seemingly improbable 'negative oil' prognostications suddenly appear prescient.

Other maturities with oil-related assets such as Brent took it on the chin, too, recording double-digit declines.

None, however, came anywhere close to the WTI crash, which adds to the sense of the mystique in the oil markets.

Negative oil prices is an absurd notion that essentially means that producers would pay traders to take the oil off their hands. However, there's more to it than meets the eye in the sometimes arcane and convoluted world of futures trading.

Front-Month Futures

We will be hearing more of this in the coming days and weeks after forensics analysts have done a deep dive into the day's trades. The early consensus though, seems to point to one culprit: The United States Oil Fund LP (NYSEARCA: USO), the country's largest long-only crude oil exchange-traded fund (ETF) with $2.35B in net assets.

As of last week, USO owned 25% of the outstanding volume of May WTI oil futures contracts as per Bloomberg.

The May contract was set to expire on Tuesday, meaning owners of this paper oil had to take physical delivery of the underlying oil assets they represented.

However, it's impractical for ETF buyers like USO's general partner/sponsor is U.S. Commodity Funds, LLC (USCF), to take physical delivery of all those millions of barrels of oil, leaving them with selling the contracts as the only viable option.

But dumping such huge volumes of contracts in such a dire market is just the perfect recipe for disaster.

The big issue here is that USO has an obligation to invest in front-month WTI contracts and to roll them over two weeks before the month ends under its investment mandate. Rolling contracts in this manner exposes USO to either contango, whereby the market prices the future at a premium relative to the front-month, or the reverse known as backwardation, whereby the market discounts the future versus the front-month.

Premium: The Oil Sector That Will Suffer The Most

Indeed, the Financial Times reported that USO recorded inflows of $1.5 billion as oil prices sunk to fresh lows.

Traders are, of course, always waiting for opportunities like these to pounce.

The front-running made the contango even stronger, with traders even stockpiling physical oil and putting it into storage to sell in the future for a guaranteed profit. Right now, WTI crude futures are in deep contango with the contango very front-loaded, meaning traders and speculators largely believe that oil prices will improve significantly as the months roll on.

Other near-term futures contracts have also been caught up in the melee, including the June WTI contract, which is down 25.8% over the past 24 hours to $15.20/barrel while USO ETF itself has lost 20.5% of its value.

USO recently announced that it would move 20% of the WTI contracts it holds into later months in a bid to lower volatility. But maybe the fund needs to join the likes of XIV, the notorious inverse VIX exchange-traded note that roiled the markets and left millions in a world of pain before being discontinued by its issuer, Credit Suisse.

The May 2020 WTI futures contract sunk an agonizing 310% to minus $38.45/barrel by late Monday afternoon, marking the first time that a futures contract for U.S. crude prices went negative--and made all those seemingly improbable 'negative oil' prognostications suddenly appear prescient.

Other maturities with oil-related assets such as Brent took it on the chin, too, recording double-digit declines.

None, however, came anywhere close to the WTI crash, which adds to the sense of the mystique in the oil markets.

Negative oil prices is an absurd notion that essentially means that producers would pay traders to take the oil off their hands. However, there's more to it than meets the eye in the sometimes arcane and convoluted world of futures trading.

Front-Month Futures

We will be hearing more of this in the coming days and weeks after forensics analysts have done a deep dive into the day's trades. The early consensus though, seems to point to one culprit: The United States Oil Fund LP (NYSEARCA: USO), the country's largest long-only crude oil exchange-traded fund (ETF) with $2.35B in net assets.

As of last week, USO owned 25% of the outstanding volume of May WTI oil futures contracts as per Bloomberg.

The May contract was set to expire on Tuesday, meaning owners of this paper oil had to take physical delivery of the underlying oil assets they represented.

However, it's impractical for ETF buyers like USO's general partner/sponsor is U.S. Commodity Funds, LLC (USCF), to take physical delivery of all those millions of barrels of oil, leaving them with selling the contracts as the only viable option.

But dumping such huge volumes of contracts in such a dire market is just the perfect recipe for disaster.

The big issue here is that USO has an obligation to invest in front-month WTI contracts and to roll them over two weeks before the month ends under its investment mandate. Rolling contracts in this manner exposes USO to either contango, whereby the market prices the future at a premium relative to the front-month, or the reverse known as backwardation, whereby the market discounts the future versus the front-month.

Premium: The Oil Sector That Will Suffer The Most

Indeed, the Financial Times reported that USO recorded inflows of $1.5 billion as oil prices sunk to fresh lows.

Traders are, of course, always waiting for opportunities like these to pounce.

The front-running made the contango even stronger, with traders even stockpiling physical oil and putting it into storage to sell in the future for a guaranteed profit. Right now, WTI crude futures are in deep contango with the contango very front-loaded, meaning traders and speculators largely believe that oil prices will improve significantly as the months roll on.

Other near-term futures contracts have also been caught up in the melee, including the June WTI contract, which is down 25.8% over the past 24 hours to $15.20/barrel while USO ETF itself has lost 20.5% of its value.

USO recently announced that it would move 20% of the WTI contracts it holds into later months in a bid to lower volatility. But maybe the fund needs to join the likes of XIV, the notorious inverse VIX exchange-traded note that roiled the markets and left millions in a world of pain before being discontinued by its issuer, Credit Suisse.

评论

发表评论